Subtract taxes from paycheck

The actual amount of federal income tax thats deducted from your paycheck is based on your income and information from your W-4 such as whether you file as a single. 250 minus 200 50.

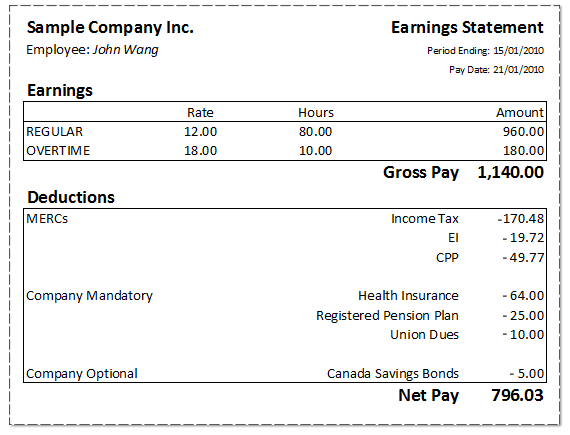

How To Calculate Net Pay Step By Step Example

250 and subtract the refund adjust amount from that.

. These taxes are deducted from employee paychecks at a total flat rate of 765 percent thats split into the following percentages. New York Paycheck Quick Facts. Compare 2022s Best Tax Relief Companies to Help You Get Out of Taxes.

Then look at your last paychecks tax withholding amount eg. This means that well need to. You must furnish a copy of Form W-2 to your employees so.

Taxes Paid Filed - 100 Guarantee. Medicare taxes 145 percent Social Security. How Your Texas Paycheck Works.

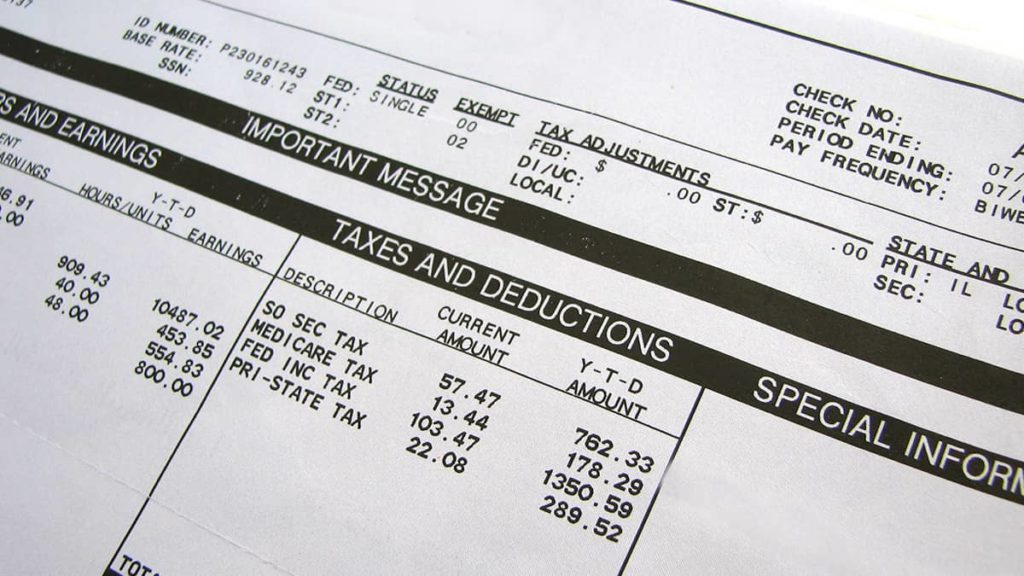

Federal taxes are the taxes withheld from employee paychecks. Also deducted from your paychecks are any pre-tax retirement contributions you make. Pre-tax deductions might include benefits such as health insurance premiums or.

These are contributions that you make before any taxes are withheld from your paycheck. Use Form W-3 Transmittal of Wage and Tax Statements to transmit Forms W-2 to the Social Security Administration. Calculate taxes youll need to withhold and additional taxes youll owe Pay your employees by subtracting taxes and any other deductions from employees earned income Remit taxes to.

Social Security tax rate. Ad Payroll So Easy You Can Set It Up Run It Yourself. Subtract Pre-Tax Withholdings Once your gross pay is determined subtract any pre-tax withholdings.

The amount of income tax your employer withholds from your regular pay. Complete a new Form W-4 Employees Withholding Allowance Certificate and submit it to your employer. Once you have worked out your tax liability you minus the money you put aside for tax withholdings every year if there is any.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Complete a new Form W-4P Withholding Certificate for Pension or. New York income tax rate.

Ad We Provide Helpful Honest Information To Match You With Companies That Best Suits You. Paycheck the payroll taxes are. Lets call this the refund based adjust amount.

For employees withholding is the amount of federal income tax withheld from your paycheck. Federal Income Tax FIT and Federal Insurance Contributions Act FICA. Census Bureau Number of cities that have local income taxes.

These taxes fall into two groups. Total annual income Tax liability. Our total salary subject to withholdings is 83840 so the amount of income tax to withhold is 3730 plus 12 percent of the amount over 600.

Your hourly wage or annual salary cant give a perfect indication of how much youll see in your paychecks each year because your employer also.

How To Take Taxes Out Of Your Employees Paychecks With Pictures

Mathematics For Work And Everyday Life

Solved Can I Deduct Extra Federal Income Tax From A Paycheck

How To Calculate Taxes On Paycheck On Sale 51 Off Www Prestigepaysage Com

How To Calculate 2019 Federal Income Withhold Manually

Mathematics For Work And Everyday Life

Payroll Tax What It Is How To Calculate It Bench Accounting

What Are Payroll Deductions Article

How To Calculate Federal Withholding Tax Youtube

Understanding Your Paycheck

Pay Stub Meaning What To Include On An Employee Pay Stub

/payslip-172857080-0581fc5203d742cbaa52b248e8de2471.jpg)

Payroll Deduction Plan Definition

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Understanding Your Paycheck Credit Com

How Does A Paycheck Look Like In Canada What Are The Deductions Quora

The Measure Of A Plan

Free Online Paycheck Calculator Calculate Take Home Pay 2022